401K To Gold IRA

Investors can earn guaranteed interest, security, and peace of mind with gold. Most experts have even considered gold as a safe haven for centuries. And with gold investment companies, you can take advantage of services to help you reach your individual goals.

Gold IRA companies provide various gold investment strategies and support for investors. With these companies, individuals can gain financial freedom through the use of gold while addressing the long-term implications of global currency devaluation and world economy changes.

As one of the oldest precious metals available for trade, gold is considered a stable source of wealth and has, in many cases, outpaced the rate of inflation. Many investors believe that it is one of the simplest and most innovative ways to protect their wealth in any economic climate. Throughout the tumultuous economic climate, precious metals and other essential commodities have proven to be effective hedges against uncertain futures.

What is a Gold-Backed IRA?

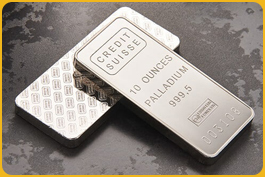

A Gold IRA is a type of Individual Retirement Account (IRA) that provides investors with direct ownership of precious metals. Also called a Precious Metals IRA, a Gold IRA can include silver, platinum, and palladium.

This account is also known as a Self-Directed IRA. It allows you to create your portfolio of investments that are tax-deferred and outside of the traditional banking system. This type of account gives investors the freedom to create a portfolio that caters to their financial goals by investing in literally anything they choose.

Are Gold and Silver IRAs a good idea?

Gold IRAs appeal to investors who are looking for a diversified retirement portfolio. With the price of gold generally moving in the opposite direction of other paper assets, this type of IRA provides an insurance policy against inflation, so your savings will keep pace with rising prices.

The price of gold has remained relatively constant over time. It will not lose any purchasing power if inflation goes out of control. Long-term investors are wise to invest in gold, as it increases its value in times of economic distress.

What are the pros and cons of Gold IRAs?

Investing in gold can prove to be an excellent way to generate additional income. However, there is no perfect investment. Gold comes with its own set of obstacles that one must figure out how best to overcome.

There are many pros and cons to discuss when making this decision. We have outlined a few of the primary drawbacks to investing in gold below, as well as the reasons you might want to consider when opening up a Gold IRA account.

PROS

Gold is a trusted investment option because it has long been a reliable source of wealth and value for most investors. There are several different options for how you can invest in gold. You can purchase physical gold bullion, gold certificates, or shares of the world’s largest gold mining companies. Like rare precious metals, you should include these alternative asset classes in your portfolio since they offer diversity and can even protect your wealth from inflation.

Many investors choose to invest in gold because it has historically retained its value better than any other currency. Due to its unique value proposition, gold has become an invaluable resource and an unparalleled investment option for millions of people worldwide. It is a hedge against times of economic uncertainty, offering a guarantee for wealth preservation with asset holdings that never debase or decrease in purchasing power.

The price of gold is not influenced by the economy, unlike the value of stocks or cash. Gold has been a hedge against recession and economic uncertainty throughout history and continues to be a safe investment during times of market volatility.

With the universal recognition of gold, owning it is one of the most important steps you can take for your financial and personal security. It provides a safe place for your wealth during times of political and economic uncertainty as its liquidity makes it easily, quickly, and cheaply converted to any currency. Gold is a viable store of value for people from all walks of life, regardless of their geographic location or political and religious background.

The Internal Revenue Service (IRS) sanctions this retirement savings vehicle. A Gold IRA focuses on both tax benefits as well as the potential for investment returns. Selling or exchanging coins or bullion may generate taxable income and be subject to capital gains taxes. However, it still holds significantly lower tax liabilities compared to other investment options. Gold held in an Individual Retirement Account allows for tax deferral, which means that you will not pay taxes on any profits until you withdraw the money at retirement. This perk also means that the government will receive less money. At the same time, more is left in your pocket or invested into your retirement account, growing until you need it for retirement.

CONS

No one can predict the future of monetary policy. Over the last five years, gold has increased in value significantly, outpacing all other commodities. While its growth rate cannot be predicted or measured by any currency, supply and demand determine the relative worth of gold.

A Gold IRA comes with the same benefits as most other types of IRAs, such as maximum tax-deferred savings and liquidity options. However, holding precious metals pays no interest or dividends and has no yields. You will only get a break on any capital gain if you sell your gold for a profit.

There are expenses associated with Precious Metals IRAs. There are transaction fees, storage fees, and insurance fees that can negatively impact the returns of gold investment. Gold IRA fees are higher than those for Traditional IRAs at the start of your investment. Still, they are likely to decrease in the future since storage fees generally become more expensive over time. However, these payments can significantly vary depending on the investment company you choose.

Gold IRA custodians must be permitted by the IRS and authorized to hold gold for IRAs. Since they are tangible, precious metals can be stolen or lost, and your custodian must insure your assets against those risks. It is vital to trust your investments with a suitable custodian. Because it is easy to spend money without realizing it, a reliable retirement account custodian will ensure that customers have the proper insurance to protect them.

Who is the best company to buy gold from?

How do I protect my Gold IRA from a market crash?

What is the best Metal to invest in right now?

Once you understand the basics of investing, you will want to expand your portfolio. You can do this by diversifying into precious and rare metals. However, investing in precious metals can get complicated, so buying gold and silver is the best place to start. These metals are more stable than other potential investments, and they will always be worth something if you ever need to sell them.

Can I move my 401(k) to a Self-Directed IRA?

Yes, transferring your 401(k) to a Self-Directed IRA is a well-known measure that investors use as a way to invest in gold. You can also move other qualified retirement assets such as your Traditional IRA and Roth IRA directly to a Self-Directed IRA through a transfer or rollover process.

Access to self-directed investing is limited in most retirement plans. However, a Self-Directed IRA provides investors with control and freedom in their investment direction. This liberty allows qualified individuals to invest in a wide array of assets including real estate, businesses, and precious metals.

How do I convert my 401(k) to a Gold IRA?

Interested investors who would like to convert their 401(k) funds to a Gold IRA will become eligible to do so once they separate from their employer managing the account. They may also do so when the provisions or custodian of the retirement plan changes.

First, your current custodian will work with you to establish a new Self-Directed IRA account with a new custodian. This new custodian will then request the rollover of your assets from your current custodian in a tax and penalty-free process. Once you invest your assets into your new Gold IRA account, you can now decide on the exact type of precious metals you want to purchase.

Is gold a good investment in 2021?

The global financial instability we are experiencing is increasing rapidly. And experts predict that this will cause a decline in the dollar’s purchasing power sooner than we can expect. In this kind of scenario, we believe gold to be one of the best investment options for most people.

Experts expect gold to continue increasing in value until the first two quarters of 2021 due to the weakness of the US dollar and interest rates remaining low. However, when the global economy returns to normal, gold may experience rapid price decreases. Fortunately, the experts are still predicting a solid year for gold. Favorable market dynamics and an optimistic outlook for the price of gold over the next five years also support this hope.

This precious metal is not the most profitable investment for impatient investors. It does not bring immediate benefits, and one can only expect a substantial profit in the long run. If you are not ready to wait for a few years, it will be better to divert your attention to the stocks of gold mining companies instead.

Gold prices and global stock markets are highly correlated, which means that gold prices tend to go up when stocks fall and vice versa. This tendency comes from how investors use gold during an economic downturn. As precious metals are intrinsically linked to the performance of the global financial markets and therefore function as a hedge in times of economic uncertainty, the outlook on these commodities is rather promising.

But due to increasing political uncertainties, global financial markets are experiencing significant volatility, and the price of gold depends on the current market conditions. It can fluctuate considerably depending upon current demand and supply, political factors, and market fluctuations.

So, is gold a good investment in 2021? It is rather difficult to determine possible development patterns and even more complicated to provide long-term forecasts concerning the price of gold.

A well-placed investment today could lead to a flourishing retirement in the future. But it takes time and energy to make such a decision. Look at the fundamentals, review charts and indicators, and always remember to take into account your personal goals.